Evaluation

Resource One to has the benefit of some of the high rates of every offers factors i review. In addition to, you could potentially rely on keeping those individuals productivity since bank doesn’t costs account repair fees.

Having full-services twigs into the eight states also Washington, D.C., Money That even offers a physical visibility, including good online gadgets and you can software experience. The firm has recently introduced Financing One to Cafes inside the large metropolitan areas into the seven says across the country, incorporating several other opportunity for face-to-deal with affairs.

Plus the Resource You to definitely 360 Efficiency Checking account, Financing You to definitely even offers nine certification away from put (CD) profile, one of almost every other products.

If you are searching to have a location to park your money you to definitely earns very good focus and in addition causes it to be fairly available in situation need dollars getting an urgent situation otherwise an advance payment, it’s worth taking into consideration the countless deals possibilities Money One brings.

Money One to Financial Evaluation

Financial support A person is perhaps one of the most identifiable financial brands not simply in the You.S., however in Canada and the You.K., as well. Carrying out as the a small business mainly based into the 1988, the firm is continuing to grow so you can a fortune five-hundred team offering an effective list of financial, spending and you can borrowing selection and more. Moreover it also provides a number of individual funds training characteristics and you will materials.

The firm claims a handy and you can valuable feel into buyers they provides. Featuring its wide array of monetary products, it can certainly feel much easier to you if you are looking so you can remain any account in one place. Particularly, you might unlock a capital You to bank card and you may an investment One IRA, putting on the ease at the job with only you to definitely facilities. And additionally, you’ll be able to create every accounts by the going on the internet, getting in touch with or seeing certainly their of numerous physical twigs.

- Deals & MMA

- CD’s

Financial support You to definitely Bank account Has actually

Along with their other economic offerings, Financing You to also offers a number of different types of discounts account. They’ve been a classic bank account and different Computer game accounts. The firm even offers some of the finest APYs linked to each savings account. And, you could stop account fix fees after you unlock certainly one of these offers accounts.

Resource That brings FDIC (Federal Put Insurance policies Corporation) safety on your own deposits up to the brand new legal matter. Most checking account versions manage give a few options with regards to away from what type of account we wish to open. It indicates you could potentially unlock a merchant account sometimes once the an individual account, a mutual membership, a mutual account having a small or a full time income believe membership.

Funding tribal installment loans You to 360 On the internet Savings Account

Regarding the basic offers profile, Capital You to definitely offers the 360 Overall performance Savings account while the Kids Bank account. The brand new 360 Performance Savings account also offers a two.25% APY having attract compounded month-to-month. There is absolutely no lowest matter you have to deposit very first, nor could there be at least matter you have got to care for inside new account. Your money tend to earn appeal it doesn’t matter what much cash is to the.

You’ll find one or two costs that you could find having a 360 Abilities Coupons Accountpleting an outbound domestic wire import commonly charge a fee, due to the fact commonly a duplicate of a statement generated during the last 2 years. Your ount away from outgoing purchases. Youre limited by half a dozen outbound transactions of the federal laws.

And make in initial deposit into your 360 Performance Family savings, you’ve got a few options. You can even put money over the telephone, on line, mailing a check, an electronic digital loans import or a residential cable transfer. It’s also possible to put bucks. How much time between your deposit and its particular supply will differ according to particular put, you could constantly predict the amount of money once four days.

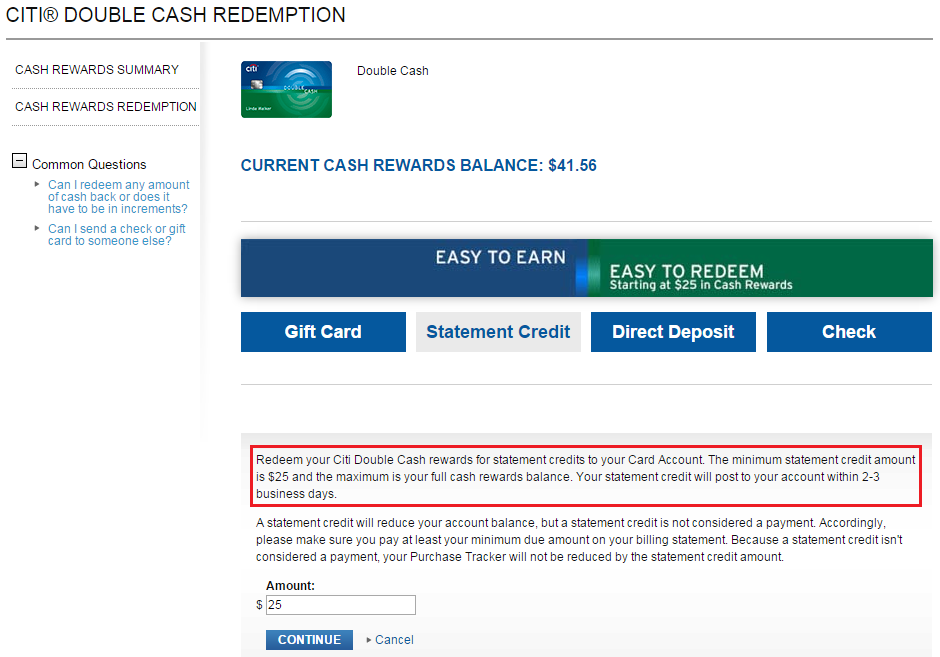

Withdrawing money from your 360 Show Checking account can be as effortless as the calling customer service otherwise going online. You can not withdraw more what’s on your membership on day. You will also have to monitor their withdrawals once the you are simply for half a dozen outbound deals for each declaration years. Exceeding one maximum will end up from inside the a punishment percentage. If you find yourself not knowing exactly how many transactions you have made, you’ll be able to head to your web account and take control of your account(s) with the their membership webpage (particularly found more than).

The capital You to definitely Children Bank account makes you deposit money into a make up your son or daughter to coach him or her regarding the saving and you can investing. This membership and is sold with zero maintenance charges or equilibrium/deposit minimums, which will help amuse guy one savings has no so you can be expensive. Truly the only percentage listed in the new membership disclosure is for a good backup of the declaration. The youngsters Bank account features an excellent 0.30% APY, which means that your kid’s discounts shall be aswell stitched, particularly your own personal. The brand new processes out-of depositing and you may withdrawing money are the same given that new 360 Show Savings account.

One another profile provide accessibility Financing Your Automated Savings Plan. This option allows you to place their savings account options and you will then return so you can autopilot. Your own account perform all of the increasing and all of the work. This is a great program particularly for the youngsters Bank account, and that means you plus boy can view the money build instead of much be concerned. To your easy an online site and you can a mobile application, you can replace your options anytime. Regarding cover, each other profile are also FDIC-covered doing new court matter.

You may have a number of different alternatives regarding offers account ownership. Which have either membership, you could potentially discover it as an individual account, a combined account or while the a living faith account. You can find further rules and regulations encompassing starting a shared account and you may a living trust membership. You should make sure you discover your own arrangement records to learn exactly what’s entailed. In the example of the youngsters Savings account, you are able to open it as a combined account having a small. This means that lesser plus one mature each other individual the newest deals account.